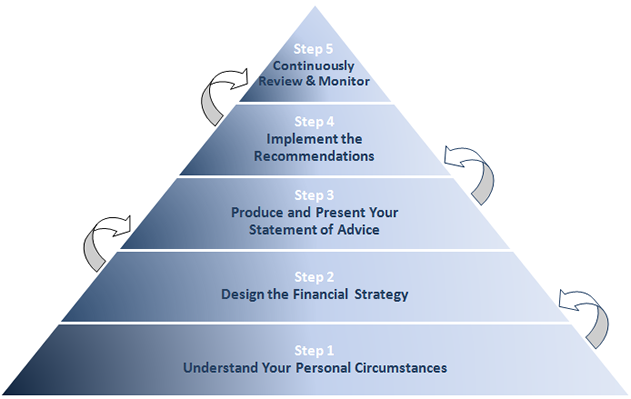

The Financial Planning Process

Executive Wealth Solutions has a five step financial planning process:

Step 1 - Understand Your Personal Circumstances

So that we can provide the best advice possible, we firstly need to collect all your current financial and personal information. This information is collected by asking you to complete a Data Collection Form.

Once we have received the completed data collection form, we will organise an initial meeting with you. The purpose of this initial meeting is to get know each other, discuss your financial matters and goals, and also answer any questions.

Step 2 - Design the Financial Strategy

Following your initial meeting it is likely that we would need to collect more financial information, usually by making enquiries into current investments. We then develop a financial strategy which will produce the best outcome and achieve your goals and objectives.

Step 3 - Produce and Present Your Statement of Advice

We will produce a Statement of Advice and present this to you at a meeting. Every aspect of this report is discussed in detail so that you can be comfortable and confident with all recommendations provided.

Step 4 - Implement the Recommendations

We will produce all paperwork and assist you in completing the paperwork required to implement all recommendations contained within the Statement of Advice. We will process this paperwork and insure all recommendations are implemented in a timely manner.

Step 5 - Continuously Review and Monitor

It is critical that all recommendations made are continuously reviewed and monitored. Changes to the quality of your investments, changes in your personal circumstances, legislation changes, and changes in investment markets are just some of the reasons why reviewing and adjusting your financial plan is critical to achieving your goals.